Reviewing NFT Tools Part 5: WGMI.io

My honest and mercifully brief review of WGMI.io's Premium Subscription

Welcome to Part 5 of NFT Tools Review Week! To recap: On Monday, I talked about the rise of NFT tools and my review methodology. In Part 2, I reviewed Nansen. Part 3 featured my review of Icy.Tools. In Part 4, I discussed Coniun. Today I will be reviewing WGMI.io. When I planned this series, I did not intend to present these tools in the order in which I’d tried them, but somehow that’s what happened.

I mention that because I have used WGMI.io for the least amount of time out of all these tools, so my review can’t speak to how it’s changed; I also haven’t interacted with the customer service at all. Therefore, in this review I’m primarily considering policies and how easy it is to find information or contact someone which I haven’t tried yet as I have not needed to. Please keep in mind that I’ve only used WGMI.io for about a week, and the lower-level subscription at that. I don’t want to seem unfair or overly critical of the service. WGMI, like all the other tools I have reviewed, is presumably under active development, so it could change fast.

WGMI: An Overview

WGMI is named after the popular NFT acronym “We’re [all] gonna make it.”

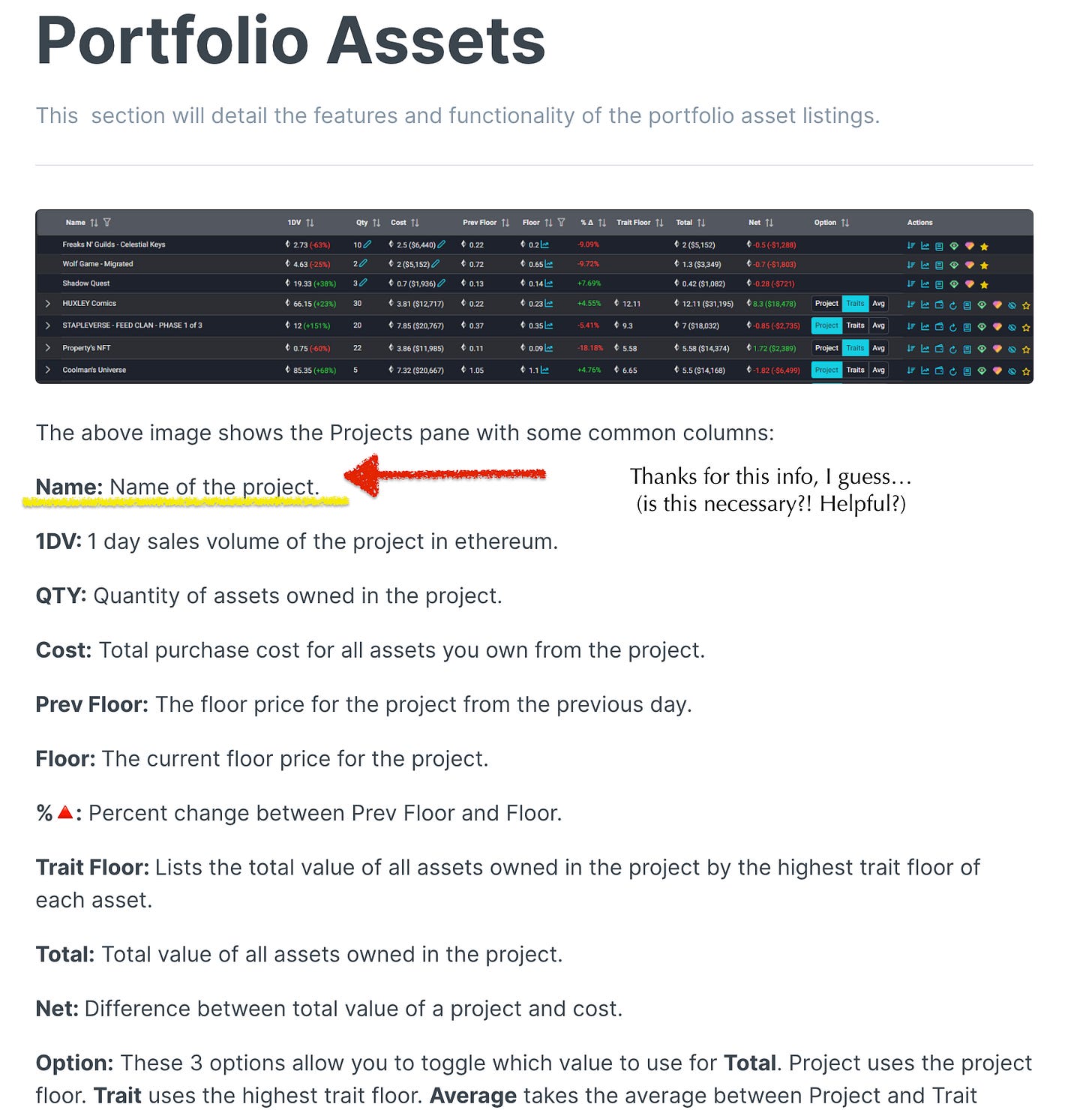

In their own words: “WGMI.IO provides a number of services to help give its users tools to aid in analysis and quality of life in the NFT space.” <source: https://wgmi-io.gitbook.io/wgmi.io-premium-feature-guide/> . Its features primarily help users track wallet valuation based on the project floor price or individual traits of an item. WGMI’s unique features are supposed to be wallet valuation and calculating losses or gains, particularly through a profit target setting that lets you identify strike points and prices.

As of April 1, 2022. WGMI’s floor price is 0.14 ETH (Currently ~$481.19 USD). There are 5,250 tokens according to the description on OpenSea, but OpenSea also says there are 4,022 items. The token lets you access premium features. For token holders, “Premium Plus” is $500 USD annually for the first year, $150 quarterly (I don't know if that is for the first year or quarter), and can be paid for with either crypto or fiat. If you don’t hold a token, access is $1,000 annually or $300 quarterly. Apparently, the token was offered free to early users of the site prior to the pivot to a subscription model. If you pay with a card, the transaction is processed by Stripe, which is a reputable and safe payment processor.

Because I found WGMI’s pricing model confusing and wasn't aware of the differences before I bought the token, feast your eyes upon this handy infographic!

My Experience with WGMI

I’ve only been using WGMI for about a week, and I haven’t played around with all its features. So take what I say with some salt. I learned of it from a YouTube video on a channel I trust and decided to give it a try. Because I find pricing NFT’s – or anything at all, really –to be quite difficult, I wanted to try the profit target feature in particular. I hoped it would simplify tracking wallet profits and losses over time and would help me identify price points.

My overall impression after a week is that WGMI.io is frustrating to use, expensive, and its unique features do not add much value for me.

Part of that is just how it fits with my strategy, because the tools emphasize rarity-based trading and longer-term holding. Another part is what I perceive as a lack of transparency about the pricing model. I absolutely could and should have investigated it more before buying the token, so that is probably on me.

Relative to the price, the unique features are also disappointing. WGMI.io seems to work best for NFT traders or holders with different strategies than mine. I don’t tend to hold for a long time. When I do, it’s usually because these have turned out to be “brown chip” (ahem) projects that I no longer expect to sell. I’m not that interested in trait floors or individual item rarity, so the Premium features do not add much value for me. Maybe they will for you.

Finally, it may be because of my Wi-Fi setup and the fact that I’m overdue for a computer upgrade, but the site seems slooooow. But I’m not totally down on WGMI.io.

What I Like About WGMI

WGMI.io has some promising features, though other services could easily replicate most of them.

The one WGMI feature I like that the other tools don’t seem to have is the listings chart. I really like that there’s a listings page for each project showing how listings have declined over time. Coniun, thus far, only shows current listings – and that’s useful – but the comparative listings information has been helpful to me because decrease or increase in listings can be useful for making decisions about entry and exit points.

I wasn’t early enough to WGMI to mint the token, but I do think it’s nice that they apparently gave their early supporters the NFT for free. If I had been using the service and only had to “claim” it (presumably paying only gas), I would’ve been thrilled.

You can include the gas you paid for an item in the valuation. I really like that feature, because otherwise I find myself on Etherscan looking up old transactions.

The public front page includes the “floor gap,” or the difference between the current floor and the second-cheapest item. I think that otherwise, this feature is only for Premium+, but it is or would be a great one – especially because so many people panic if they see a floor price they perceive as too low.

Exporting your data as an .xlsx is very easy, though you can’t easily change the format (it’d be nice to be able to download in .csv, etc.).

If you have Premium+, you can set a profit target in either crypto or USD. I can’t tell if you can then automatically program a listing to execute - that would be a game changer.

What WGMI Could Improve

The UI is bad. It looks like a bare-bones work in progress – not something I’d pay $1000 a year for! In case my perception is subjective, I hate the site’s almost nonexistent internal navigation. I wish I could zoom in on graphs. Although there’s a way to customize the watchlist / feed, it is really counterintuitive because the “watchlist” is different from “Favorites” – at least, I think so. I can’t really tell. I think what I see in “Activity” is my “favorites,” and if I enter the OpenSea slug,1 it…. Well, when I’ve tried,

it tells me it’s not a valid slug(oops, that’s only with newer projects or ones that had slug changes, which OpenSea does constantly)… sometimes it accepts the slug and then the project is added to the “watchlist.” Note that this feature doesn't work with LooksRare or presumably, any other sites or markets. Also, I don’t like perma-dark mode (it annoys me about Coniun sometimes, too). I really, really don’t like that the premium version is so gated-off from the rest of the site that I can’t navigate. There are links to social media from WGMI’s front page, which I can’t click to from the wallet page.If my wallet is connected, the only way to find out more information about WGMI, including social media links, is to manually go to WGMI.io (instead of the default wgmi.io/wallet) or open up an Incognito window, or click on the Twitter/ Discord icons on the OpenSea page. There’s no site header or footer. There’s no navigation.

Instructions are nonexistent. The documentation in the “Premium Feature Guide” is neither helpful, nor thorough, nor usefully written. I’m not just being a pedantic ex-professor here. I cannot imagine anyone reading that document and finding answers to questions, much less feeling great about a purchase:

The guide mostly glosses the icons and names of table headings, most of which would be intuitive to anyone who’s used tables, or Excel, or a computer. I am neither a genius or nor the village idiot, but on the basis of the guide alone and how many times I have read it in the past week, I don’t have a very clear understanding of the compelling or unique features, the differences between Premium and Premium+, or who I can contact with additional questions (Disclosure: I didn't for this article).

What You Should Know about WGMI

To use the “Premium Plus” features like profit target, you need to buy the WGMI NFT and subscribe. I thought that was obnoxious. To be honest, I don’t think I would have bought the NFT if I’d known that. There do seem to be a lot of opportunities for a discounted subscription rate, but those discounts only seem to last for a limited amount of time and then you pay the full rate even if you own the token. It seems like the token really has little point because even though you get “lifetime” access, a) it’s access to the mere “Premium” version and b) even the discount to Premium+ expires.

WGMI is more for wallet and collection management / data than for tracking the market. It doesn't have mint tracking. Its market aggregation on the public dashboard is not distinct from the others, except in its ultra-minimalist design.

There’s no free trial or any way to really see how this will work for you until after you subscribe and / or buy a token. The public dashboard doesn't’ even have a title, so when you look at it, you can’t really tell what it is: Top projects on OpenSea by volume? Top projects by number of transactions? That makes it even harder to tell if WGMI.io could be right for you.

As with all these tools, there is a lot planned for the future (according to this Tweet, not the documentation or customer-facing website). Maybe it’ll be the best tool yet in a few months. I really am keeping an open mind.

My Verdict

WGMI is not for me. It doesn't seem ready for prime time, and the features it has that might change that perception are either limited to the top-shelf subscription or not relevant to my trading activity, or both. What WGMI.io does well right now is simplifying a tedious process that’s not applicable to most portfolios.

I’ve listed my token; hopefully someone else can get more value out of it than I did. If you have a lot of high-value, rare, long holds, then this might be a good tool but frankly, on the other hand, if you have that kind of NFT portfolio, you should just hire a CPA or something2 to calculate your gains. It’s not that difficult to just make a spreadsheet of your own and identify profit targets that way, which is what I will do from now on.

WGMI.io’s Premium or Premium+ subscription could be a good tool for a specific type of NFT trader. That would be someone with a growing portfolio of items they’ve held for a long time – especially extremely valuable ones. I’m not sure this would be as useful of a tool for someone who is flipping or reselling NFT’s instead of holding them for the longer term, or a novice / casual trader. If you got in early and / or are getting WGMI free, then it’s awesome. If you have a specific need for the profit target feature, WGMI could also work for you if you’re prepared to pay for Premium+. Otherwise, I cannot recommend it at this time - but who knows what the future will hold? WGMI could still surprise me. Everything is perpetually “early” in the NFT world, but if this is the WGMI party, I’ll go run out to the store and get a beer or maybe just go to another party for a while before heading back.

Have you used any of these tools? What did you think? The next time I do a series of reviews like this, which tools should I review? Please let me know in the comments!

Thanks so much for reading this long series! I have learned a lot by doing it ,and I hope it has been useful for you. Next week, I’m going to summarize these reviews and provide a comparative infographic. I’m also going to discuss some ideas for non-speculative NFT use cases. As always, reach out if you have feedback or other requests for content. Don’t miss out - make sure you’re subscribed! It’s free, and clicking this button is so easy, a lab rat could do it.

Good friends share ! Have you shared this publication yet? Do you merely yearn to press an orange button? Go for it!

Disclosures and disclaimers:

Nothing in this publication should be considered financial advice.

I currently (April 1, 2022) own 3 ConiunPass NFT’s and 1 WGMI “token.” I have a paid monthly subscription to Icy.

No companies have paid me or given me anything in exchange for this coverage. They probably do not even know I exist. All the information about these projects was accurate as of the time I wrote this, and I have verified this information to the best of my ability. None of the links I’ve used in this post are referral links unless otherwise indicated.

NFT’s for Normies seeks to produce content that contributes to the NFT space through intelligent, analytical discussion. I want to make NFT’s more accessible and appealing to different demographics, and I want to counterbalance the extremely negative coverage that dominates mainstream discourse about NFT’s.

If you really appreciate this newsletter and want to help me out, my ETH wallet is open for contributions of any size - all of which would be appreciated! And no pressure if you can’t or don’t

0x4E53CD9f9BF1A0C2f89E7af2Dd8F72b8f0cFC142

Although the site has gone to a lot of trouble to gloss terms like “name of project,” they don’t bother to explain that the slug is the text of the URL after the final backslash. Example: The slug for Part 4 of this project is “reviewing-nft-tools-part-4-coniunpass?s=w.” Users unfamiliar with this term are likely to be confused.

I realize not all CPAs are willing to comb through thousands of pages of transactions for assets with names like “Dicklebutt” (And some are just happy to over-charge for that privilege). If that’s the case, you could probably save money and time: Hire someone to assess the value from a CSV or spreadsheet. Pay a younger sibling or your child to do it. I don't know. This is not financial or legal or business advice.